Press Release

|January 02,2025Private Home Prices Jumped In Q4 2024 On Strong New Home Sales; HDB Resale Prices Rose At A Slower Pace On Softer Sales And Effects Of Tighter HDB Loan Curbs From August 2024

Share this article:

02 January 2025, Singapore - Flash estimates showed that overall private home prices reached a new peak in Q4 2024, as a spate of new launches and strong sales boosted prices. Meanwhile, in the HDB resale segment, prices of resale flats continued to rise but at a slower pace in Q4 2024, amid one of the weakest quarters of HBD flat resale volume in recent years.

Q4 2024 URA Private Residential Property Index (Flash)

Private home prices rose by 2.3% quarter-on-quarter (QOQ) in Q4 2024, reversing the 0.7% QOQ decline in the previous quarter (see Table 1). This is the fastest pace of quarterly price growth since the 2.8% QOQ increase in Q4 2023. This takes the cumulative price increase for 2024 to 3.9% - continuing a multi-year trend of slowing price growth since 2022. As per the flash estimates, the URA PPI has touched a new peak in Q4 2024 with a reading of 209.4 points. The flash estimates capture transactions up till mid-December, and the final print will be published on 24 January. With no new launches in the final weeks of December and softer sales, the final print is not expected to stray too far from the flash estimates.

Table 1: URA Private Property Price Index (PPI)

Price Indices | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 (Flash) |

(QOQ % Change) | (YOY % Change) | (QOQ % Change) | |||||||

Overall PPI | 3.3 | -0.2 | 0.8 | 2.8 | 6.8 | 1.4 | 0.9 | -0.7 | 2.3 |

Landed | 5.9 | 1.1 | -3.6 | 4.6 | 8.0 | 2.6 | 1.9 | -3.4 | -0.9 |

Non-Landed | 2.6 | -0.6 | 2.2 | 2.3 | 6.6 | 1.0 | 0.6 | 0.1 | 3.2 |

| 0.8 | -0.1 | -2.7 | 3.9 | 1.9 | 3.4 | -0.3 | -1.1 | 2.4 |

| 4.4 | -2.5 | 2.1 | -0.8 | 3.1 | 0.3 | 1.6 | 0.8 | 3.4 |

| 1.9 | 1.2 | 5.5 | 4.5 | 13.7 | 0.2 | 0.2 | 0.0 | 3.4 |

The non-landed private homes segment led the price increase, with a 3.2% QOQ jump in Q4 2024 from Q3 2024. This is the strongest quarterly growth in non-landed home prices since Q3 2022 where prices climbed by 4.4% QOQ. The sharper rise in prices did not come as a surprise, as all sub-markets witnessed price growth in the quarter, with a slew of new launches finding favour with buyers.

The Outside Central Region (OCR) and Rest of Central Region (RCR) posted the steepest increase, with prices jumping by 3.4% QOQ each in Q4 2024. The price growth in the OCR follows three quarters of muted price movement. The increase can be partly attributed to Chuan Park, which achieved a benchmark launch price for an OCR new project when it shifted 696 units at an average price of $2,579 psf in November 2024, besting the average price of $2,451 psf at J'den, when it sold 368 units during its launch in November 2023. Based on caveats lodged, Chuan Park has sold a total of 724 units (overall average price of $2,587 psf) as of 22 December. Of note, another new launch, Norwood Grand in Woodlands also helped to support prices in the OCR when it transacted 291 units (up till 22 Dec), with prices averaging at $2,080 psf following its launch in October 2024.

Similarly, non-landed home prices in the RCR saw renewed strength, climbing by 3.4% QOQ in Q4 2024, following the 0.8% QOQ growth in the previous quarter. This is the largest quarterly increase since prices grew by 4.4% QOQ in Q1 2023. The price growth in Q4 came on the back of four new launches in the RCR, namely Meyer Blue, Nava Grove, Union Square Residences, and Emerald of Katong. As at 22 December, Meyer Blue has sold 132 units at an average price of $3,243 psf, while Union Square Residences moved 106 units at an average price of $3,166 psf, according to caveats lodged. Meanwhile, Nava Grove sold 386 units with prices averaging at $2,452 psf, and Emerald of Katong shifted a whopping 840 units at an average price of $2,637 psf in Q4 2024 (till 22 Dec). Collectively, the transactions at new projects have helped to pull prices up in the RCR.

It is somewhat of a similar story in the Core Central Region (CCR), where The Collective at One Sophia - which held its preview sale in November - supported CCR prices when it sold 64 units at an average price of $2,740 psf, based on caveats lodged (up till 22 Dec). Flash estimates showed that CCR non-landed home prices snapped two straight quarters of decline with a 2.4% QOQ increase in Q4 2024. This brings the cumulative price increase in the CCR to 4.3% in 2024 - eclipsing the 1.9% growth in 2023, in a sub-market that has faced downward pressure on prices since the tightening of the additional buyer's stamp duty measure in April 2023.

Meanwhile, the landed homes segment booked a second straight quarter of price decline, with prices dipping by 0.9% QOQ in Q4 2024, after falling by 3.4% QOQ in the previous quarter. Based on URA Realis caveat data, there were a total of 425 landed home transactions in Q4 (till 23 Dec), down by about 18% from 520 deals in the previous quarter. By property types, detached home sales were up by around 8% QOQ in Q4 2024, while that of semi-detached homes and terrace houses fell by about 22% QOQ and 19% QOQ, respectively. In terms of average prices on land area, terrace houses saw a larger price increase of about 7.4% QOQ (to $1,959 psf) in Q4 2024, followed by 3.7% QOQ growth (to $1,760 psf) for semi-detached homes, and a 4.6% QOQ decline (to $1,630 psf) for that of detached houses, based on caveats lodged.

PropNex estimates that developers sold 3,453 new homes (ex. EC) in Q4 2024 (till 22 Dec), taking the total sales in 2024 to 6,502 units (ex. EC) - exceeding the 6,421 units sold in the whole of 2023. The new home sales volume in Q4 is on track to be the highest developers' sales since 3,550 units were moved in Q3 2021. In the resale market, 3,084 private homes are estimated to have been sold in the final quarter of the year, which takes the total resale volume to 13,435 units in 2024 (till 24 Dec) - also outperforming the 11,329 units resold in 2023.

Mr Ismail Gafoor, CEO of PropNex Realty said:

"We think Q4 2024 has been an impressive quarter, one that almost single-handedly pulled up the new home sales market in a year where sentiment had been relatively lacklustre. However, it is important to note that a lot of it rode on the unprecedented slew of project launches in November, the pent-up demand from limited launches in the year, and also the optimism arising from rate cuts by the US Federal Reserve starting from September.

The overall price increase of 2.3% QOQ in Q4 2024 has reversed the slight dip in prices in the previous quarter, and it the strongest pace of quarterly price growth since Q4 2023. The uptick in prices in Q4 2024, coupled with robust home sales may have stoked some concerns over possible property cooling measures being in the works. In our view, the existing measures remain largely adequate, on the one hand reining in investment demand, while on the other supporting households' aspirations of owning a private home. Besides, it may be premature to implement further measures on the basis of one quarter's performance.

We think the price increase in Q4 can be attributed mainly to new home sales where we saw several projects achieving elevated average price on a $PSF basis. There may be several reasons for this, it could be due to the project's attractive location near the MRT station and amenities (as was the case with Chuan Park); or it may be a result of the rules on the harmonisation of GFA definitions (such as Norwood Grand, Emerald of Katong, and Nava Grove). In addition, developers have to cope with high construction costs, and they are also pricing units in line with the demand for the projects.

The GFA harmonisation guidelines can help to maximise usability and efficiency of the layout, and it means the buyers are paying for the liveable space they can use. However, it could translate to a higher PSF price because the price quantum is now spread over a reduced strata area (after discounting non-useable space such as the aircon ledge, for example). Based on caveats lodged, we note that post-GFA harmonisation projects tend to have a slightly higher average unit price, compared with nearby projects that are not affected by the guidelines (see Table 2). As more projects affected by the GFA harmonisation rules are being launched, we expect any discrepancy in $PSF unit price to even out eventually.

Table 2: Price comparisons between post-GFA harmonisation projects (in bold) and nearby launches that are not affected by the GFA harmonisation rules

Project | Units sold since launch* | Average $PSF unit price | Average price |

Emerald of Katong | 840 | $2,637 | $2,335,617 |

Tembusu Grand | 583 | $2,463 | $2,254,724 |

Grand Dunman | 736 | $2,544 | $2,202,072 |

Nava Grove | 386 | $2,452 | $2,170,322 |

Pinetree Hill | 361 | $2,448 | $2,289,045 |

Lentor Mansion | 492 | $2,271 | $1,894,837 |

Hillock Green | 363 | $2,177 | $1,901,211 |

Lentor Hills Residences | 591 | $2,115 | $1,939,746 |

Lentor Modern | 604 | $2,125 | $1,930,265 |

Lentoria | 180 | $2,183 | $1,796,817 |

In 2025, we project that overall private home prices may rise by 3% to 4%, while new home sales could come in at 8,000 to 9,000 units (ex. EC), barring any unforeseen events. Based on our estimates, there could potentially be around 13,000 new units (incl. EC) that may be launched for sale by developers in 2025 - almost doubling that of 2024. In view of the ample pipeline of launches, we expect developers to price units sensitively, taking into consideration the projects' location attributes and depth of the housing demand.

Meanwhile, the resale private homes market remains quite resilient, with the total volume in 2024 outperforming that of 2023. We expect activity in the resale market to continue to be lively in 2025, with the resale volume potentially hovering at 14,000 to 15,000 units. Demand drivers in the resale private homes segment will include the sizable average price gap between non-landed private resale and new sale units, buyers' preference for larger homes, and those who need a move-in ready property. In Q4 2024 (till 24 Dec), the average unit price gap between non-landed new private homes and resale homes was nearly 48% (New: $2,559 psf vs Resale: $1,733 psf), while the gap in average price quantum was around 23% (New: $2.32 million vs Resale: $1.89 million). We anticipate that the lower new supply completions of private homes expected for 2025 may crimp resale stock and in turn, help to support private resale home prices."

Q4 2024 HDB Resale Price Index (Flash)

Flash estimates released by the Housing and Development Board (HDB) showed that prices of resale flats rose by 2.5% QOQ in Q4 2024, slowing from the 2.7% QOQ growth in the previous quarter. This marks the 19th straight quarter of price increase in the HDB resale segment. Based on the flash estimates, HDB resale prices rose by a cumulative 9.6% in 2024 - picking up from the 4.9% growth in 2023 (see Table 3).

The HDB said that 6,314 flats were resold in Q4 2024 (till 30 December 2024) - this is sharply lower than the 8,142 resale flats transacted in Q3 2024. Including the 22,562 flats resold in the first nine months of 2024, there were 28,876 resale flats transacted in the year (till 30 Dec), surpassing the 26,735 flats resold in the whole of 2023.

Table 3: HDB Resale Price Index

Quarter | QOQ % change | YOY % change |

Q1 2021 | 3.0% | 8.1% |

Q2 2021 | 3.0% | 11.0% |

Q3 2021 | 2.9% | 12.5% |

Q4 2021 | 3.4% | 12.7% |

Q1 2022 | 2.4% | 12.2% |

Q2 2022 | 2.8% | 12.0% |

Q3 2022 | 2.6% | 11.6% |

Q4 2022 | 2.3% | 10.4% |

Q1 2023 | 1.0% | 8.8% |

Q2 2023 | 1.5% | 7.5% |

Q3 2023 | 1.3% | 6.2% |

Q4 2023 | 1.1% | 4.9% |

Q1 2024 | 1.8% | 5.8% |

Q2 2024 | 2.3% | 6.6% |

Q3 2024 | 2.7% | 8.1% |

Q4 2024 (Flash) | 2.5% | 9.6% |

Ms Wong Siew Ying, Head of Research and Content, PropNex Realty said:

"HDB resale prices posted a slightly slower pace of increase in Q4 2024, with a 2.5% QOQ growth, as per the flash estimates. The moderation in price growth in Q4 came after three consecutive quarters of escalating resale flat prices from Q1 2024. The strengthening resale flat prices had prompted the government to intervene in August 2024, where a 5 percentage-point reduction in the loan-to-value (LTV) limit for HDB loans to 75% was implemented to tame the resale flat market. Going by the weaker sales and slower growth in the HDB resale price index in Q4, it could be likely that the effects of the August 2024 measure are working through the market. Meanwhile, the thinner resale volume during the quarter also likely put a drag on prices.

The resale flat volume in Q4 2024 may potentially be the weakest quarter of transactions since Q2 2020, where 3,426 flats were resold amid the Covid-19 restrictions. We think some of the reasons for the slower sales in Q4 2024 could include the typically lower transactions due to the year-end seasonal lull, and possibly the bumper crop of new build-to-order (BTO) flats launched in October that pulled some would-be buyers from the resale flat market. That said, the resale flat volume in 2024 has surpassed that of 2022 and 2023. An estimated 28,876 flats were resold in 2024 (till 30 Dec), compared with 26,735 in the entire 2023, and 27,896 in 2022.

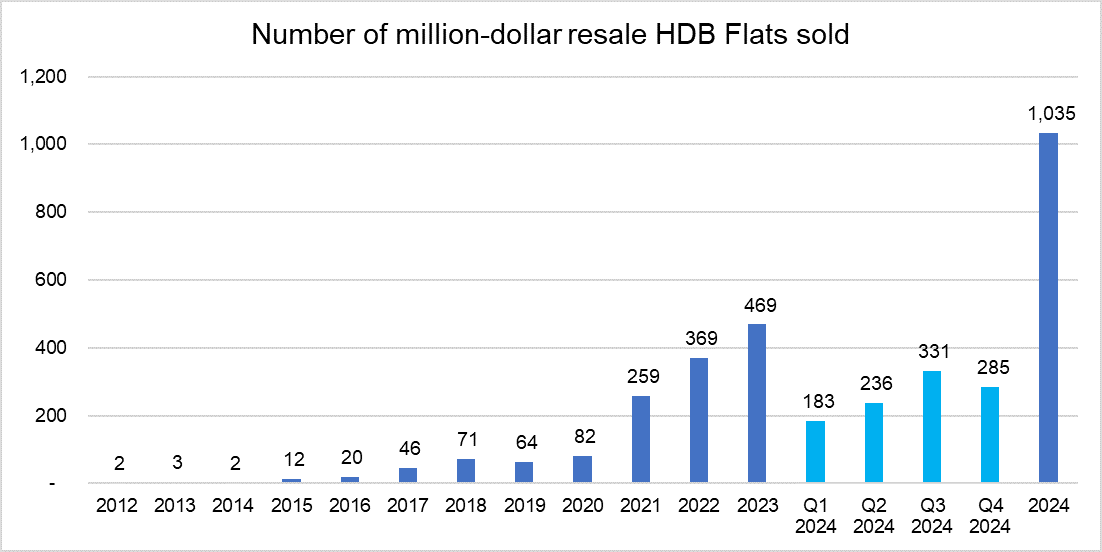

According to sales data, there were 285 flats resold for at least $1 million in Q4 2024 (till 31 Dec), down by 13.9% from the 331 units sold in the previous quarter. This takes the total number of million-dollar resale flats to 1,035 in 2024 (see Chart 1) - more than double the record 469 units sold in 2023. Of the 285 units, 127 units are 4-room flats, 105 units are 5-room flats, 52 units are executive flats, and one multi-gen flat.

Toa Payoh town led million-dollar resale flats deals in Q4 2024, with 58 such transactions - 20 of which were for 4- and 5-room units at Alkaff Vista in Bidadari Park Drive which had recently met the 5-year minimum occupation period (MOP).

Chart 1: Number of resale flats sold for at least $1 million

That there were fewer million-dollar flats resold in Q4 2024 could also be a result of the lowered LTV limit for HDB loans, which is aimed at cooling the strong demand at the top end of the HDB resale market. The 1,035 units of such flats sold still represent a small portion of the total resale volume at about 3.7%. Looking at 2025, we anticipate that the number of million-dollar resale flats could remain elevated - potentially crossing 1,000 units again - as such flats have unique attributes (such as being near the city, located near to the MRT station and/or amenities, command good views, situated on a high floor, spacious etc.) that are sought-after by buyers.

Barring any unforeseen events, we expect the HDB resale market to perform well in 2025, underpinned by healthy housing demand, and the lower number of MOP flats coming on - possibly keeping resale prices firm. Resale flats will continue to enjoy strong buying interest from those who have more pressing needs, applicants who are unable to secure a BTO flat, as well as families with a tighter housing budget. We project that HDB resale flat prices may rise by 5% to 7% in 2025, supported by a resale volume forecast of 29,000 to 30,000 units."